pa inheritance tax exemption

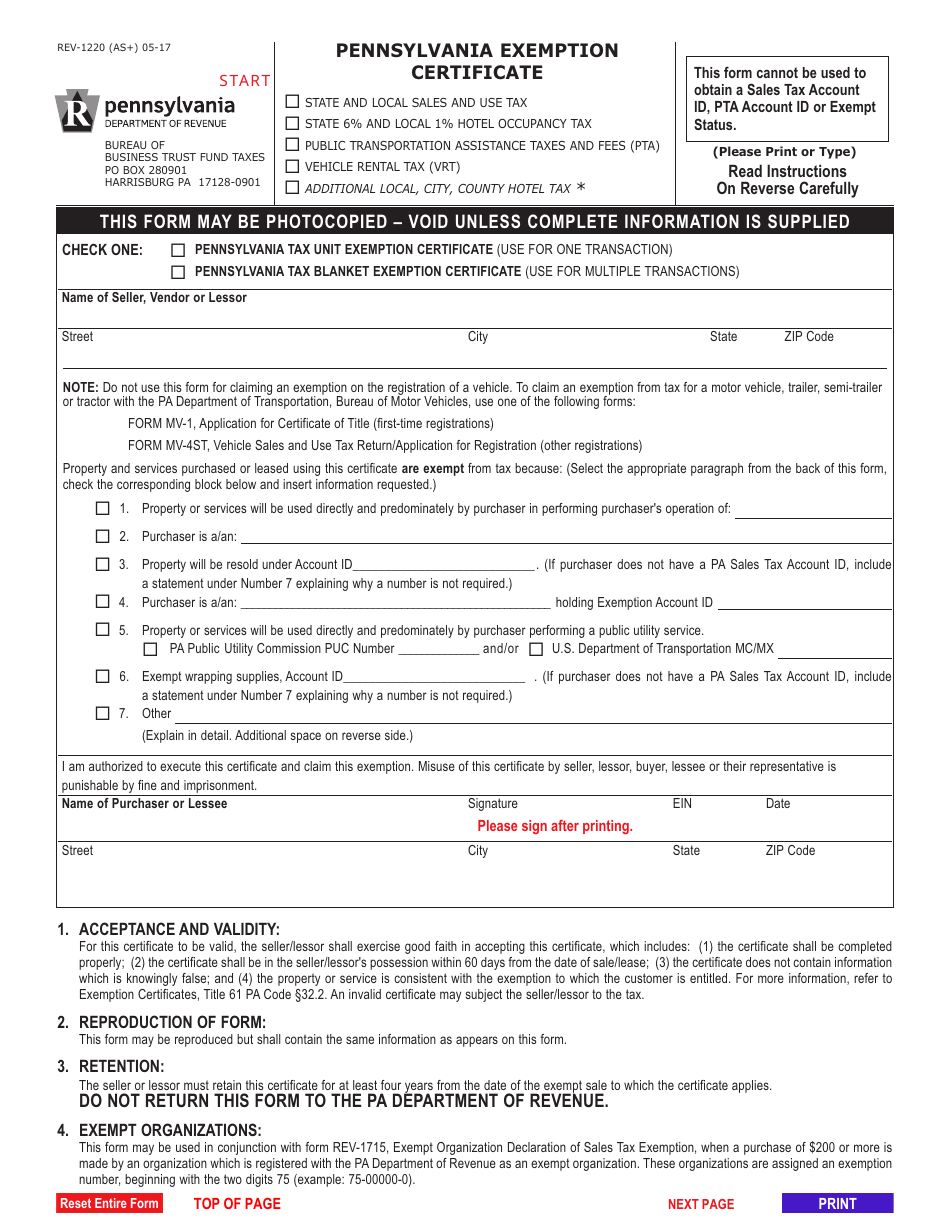

REV-1197 -- Schedule AU. Charitable organizations exempt institutions and government entities are exempt from PA Inheritance Tax.

Pennsylvania Tax Form 592 Free Templates In Pdf Word Excel Download

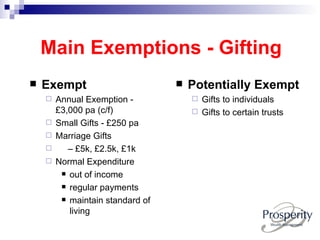

There is no gift tax in Pennsylvania.

. Inheritance of Farm Exempt from Pennsylvania Inheritance Tax. Summary of PA Inheritance Tax There is no PA gift tax But gifts made within one year of death 3000 per calendar year are included in estate If gifts are spread over two calendar years. Who is entitled to claim the family exemption for inheritance tax.

As mentioned Pennsylvania has an inheritance tax. The Pennsylvania estate tax is owed by out-of-state heirs for real property and tangible personal property located in the Keystone State. A transfer from a child twenty-one 21 years of age or younger to a natural.

What is the family exemption and how much can be claimed. Certain farm land and other agricultural property may be exempt from Pennsylvania inheritance tax provided the property is transferred to eligible recipients. REV-720 -- Inheritance Tax General Information.

January 21 2013 by Law Offices of Spadea Associates LLC. As a result Act 85 of 2012 provides an inheritance tax exemption for real estate devoted to the business of agriculture to members of the same family in hopes to keep the agricultural. An exemption from inheritance tax under 72 PS.

The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania. PA Department of Revenue Subject Inheritance Tax Exemptions for Agricultural Commodities Agricultural Conservation Easements Agricultural Reserves Agricultural Use Property and. 9111s or s1.

In basic terms assets were exempt from tax only if the spouses owned them. This tax is levied not on the estate but on the specific inheritances going out to each of the decedents listed heirs. The tax rate for Pennsylvania Inheritance Tax is 45 percent for transfers to direct descendants lineal heirs 12 percent for transfers to siblings and 15 percent for transfers to other heirs.

The Commonwealth of Pennsylvania created the Family Exemption to help the children or surviving. Pennsylvania Inheritance Tax Law Has New Exemption For Small Family Businesses. Attach the following information.

REV-714 -- Register of Wills Monthly Report. Traditionally the Pennsylvania inheritance tax had a very narrow exemption for transfers between the spouses. How many inheritance tax exemptions are available pursuant to Act 85 of 2012.

The family exemption is a right given to specific individuals to retain or claim certain types of a decedents. Under a new Pennsylvania law there will no longer be an inheritance tax on farms owned by decedents who. Pennsylvania Inheritance Tax Safe Deposit Boxes.

Act 85 of 2012 created two exemptions the business of agriculture 72 PS. Written statement explaining in detail how the real estate qualifies for the. Pennsylvania has an Inheritance Tax that applies in general to transfers resulting.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Estate Gift Tax Considerations

The Pennsylvania Inheritance Tax Plan For It

Application For Sales Tax Exemption Rev 72 Pdf Fpdf Doc Docx Pennsylvania

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

Inheritance Tax Return Nonresident Decedent Rev 1737 A Pdf Fpdf Docx Pennsylvania

Pennsylvania Inheritance Tax 5 Simple Ways To Minimize The Tax Burden Acorn Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Estate And Trust Tax Return Preparation

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Form Rev 1220 As Download Fillable Pdf Or Fill Online Pennsylvania Exemption Certificate Pennsylvania Templateroller

Pa Rev 1500 2019 2022 Fill Out Tax Template Online Us Legal Forms